estate tax unified credit amount 2021

Married residents may be able to claim a marital credit that may eliminate estate tax if the total. Through December 31 2021.

Estate Tax Exemption 2021 Amount Goes Up Union Bank

This is the amount each individual has to apply against taxable gifts during lifetime or at death.

. After the unified credit limit is reached the donor pays up to 40 percent on that exceeding the unified credit. So in 2022 a husband and wife can elect to gift-split and make combined non-taxable gifts of 32000per recipient. Get information on how the estate tax may apply to your taxable estate at your death.

For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. The estate of a New York State resident must file a New York State estate tax return if the following. Under the 2010 Tax Relief Act the lifetime estate and gift tax basic exclusion amount was 5000000 and this.

The amount of the estate tax exemption for 2022. If the resident decedent died. The 117 million exception in 2021 is set to expire in 2025.

The previous limit for 2020 was 1158 million. Does not provide investment tax legal or retirement advice or recommendations. For people who pass away in 2022 the exemption amount will be 1206 million its 117 million for 2021.

Your estate wouldnt be subject to the federal estate tax at all if its worth 12059 million or less and you were to die in 2022. Additionally in 10 years the gift and estate tax exemption will have likely reverted back to the lower 549 million amount for dates after 2025. How Might the Biden Administration Affect the Unified Tax Credit.

This year they could give each child a combined 32000 without triggering the gift tax. As of 2021 married couples can exempt 234 million. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of.

January 1 2019. For a married couple that comes to a combined exemption of 2412 million. The value of lifetime taxable gifts any gifts made in 1977 or later is added to this net amount then reduced by the unified tax credit resulting in the taxable value of the estate.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. Gifts above the 16000 per giver amount will reduce the lifetime gift and estate exemption by the amount over 16000. This means that when someone dies and.

While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the. After 2025 the exemption will revert to the 549 million exemption adjusted for inflation. Gifts and estate transfers that exceed 1206 million are subject to tax.

4625800 in 2021 4769800 in 2022 IMPORTANT DISCLOSURES Broadridge Investor Communication Solutions Inc. In New Jersey the Inheritance Tax was a credit against the Estate Tax. The New Jersey Estate Tax was phased out in two parts.

Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections. The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been increased for inflation beginning January 1 2021. The unified credit is a credit for the portion of estate tax due on taxable estates mandated by the.

Any tax due is determined after applying a credit based on an applicable exclusion amount. The IRS announced new estate and gift tax limits for 2021 during the fall of 2020. Is added to this number and the tax is computed.

ESTATE AND GIFT TAXES Estate Taxes 2021 2020 Estate tax exemption 11700000 11580000 Unified estate tax credit 4577800 4577800 Top estate tax rate 40 40 Gift Taxes 2021 2020 Lifetime gift tax exemption 11700000 11580000 Annual gift tax exclusion. The amount of the nonresidents federal gross estate plus the amount of any includible gifts exceeds the basic exclusion. The first 1206 million of your estate is therefore exempt from taxation.

The 2022 exemption is 1206 million up from 117 million in 2021. So individuals can pass 117 million to their heirsand couples can transfer twice that amountwithout. The Basic Exclusion Amount for 2022 is 12060000 Beginning in 2011 a deceased spouses unused exclusion amount known as the DSUE may be transferred to a surviving spouse by filing an estate tax return and making an election.

Qualified Small Business Property or Farm Property Deduction. In 2021 the unified credit of US4625800 provides an exemption from estate tax for estates with values up to US117 million. How the unified tax credit may apply to you depends on whether you prefer to use it to benefit the people youre giving to while youre still.

The tax is then reduced by the available unified credit. For 2021 the estate and gift tax exemption stands at 117 million per person. The unified credit is per person but a married couple can combine their exemptions.

The 2021 federal tax law applies the estate tax to any amount above 117 million. The clear trend in the past 20 years has been to increase the exemption and decrease the tax rate. That could result in your estate having to pay over 49 million in federal taxes leaving your heirs with about 1474 million in after- tax assets rather than 1964 million if you made the gift sooner.

The Applicable Exclusion Amount is the sum of the Basic Exclusion Amount plus the deceased spousal unused exclusion amount DSUE. An estate paid only the higher of the two. This amount is scheduled to sunset at the end of 2025 and as.

A key component of this exclusion is the basic exclusion amount BEA. The estategift unified credit amount will be 12060000 for 2022. For 2021 that lifetime exemption amount is 117 million.

In 2022 couples can exempt 2412 million. On or after January 1 2017 but before January 1 2018 the. January 1 2020 through December 31 2020.

On December 31 2016 or before the Estate Tax exemption was capped at 675000. Unified tax credit strategies. Value of a couples estate does not exceed US234 million.

This is called the unified credit.

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How To Avoid Estate Taxes With A Trust

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

2022 Updates To Estate And Gift Taxes Burner Law Group

2018 Estate Tax Rates The Motley Fool

What Happened To The Expected Year End Estate Tax Changes

Historical Estate Tax Exemption Amounts And Tax Rates 2022

U S Estate Tax For Canadians Manulife Investment Management

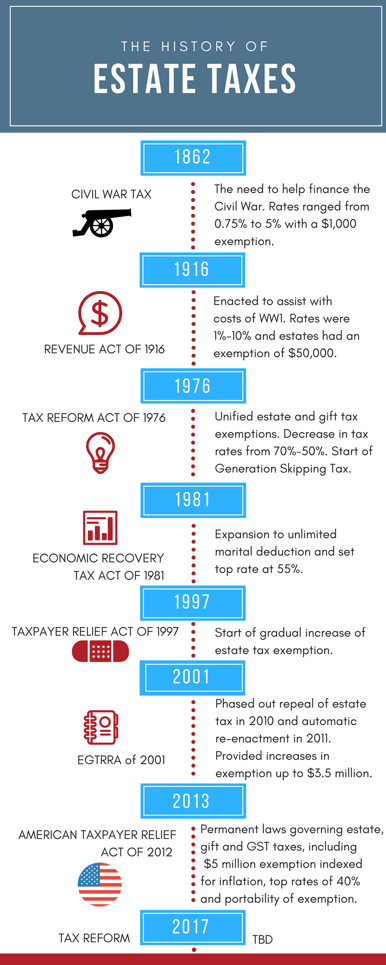

A Brief History Of Estate Gift Taxes

U S Estate Tax For Canadians Manulife Investment Management

It May Be Time To Start Worrying About The Estate Tax The New York Times

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

U S Estate Tax For Canadians Manulife Investment Management

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Exploring The Estate Tax Part 2 Journal Of Accountancy

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel